| 10 Investing Answers Every Beginner Needs Can’t tell your EPS from your IPO? This quick guide to stock market investing will set a few things straight.

Learn The Basics 1. Is there factual evidence that I’ll make money buying stocks? 2. What are the most important indicators of a stock’s health?

Though some figures can be more telling than others when evaluating a stock’s health, your assessment can’t be isolated to one or two metrics; the appropriate stock picks for your portfolio rest largely on your objective. If you seek high returns and can absorb high risk, stocks poised to increase significantly over a short time period will appeal. If you are looking for less risk and moderate growth, stick to stocks whose price ranges over the past 52 weeks have been steadier. Conduct independent research and form your own educated opinions: Do you think the company/product will be in demand 10 years from now, and do you believe in the company’s strategy in relation to the competition? Scour the annual reports of the stocks you’re considering buying to learn more about what the stock’s past performance entailed, growth strategy, and how much debt it carries. 3. Where can I find analyst research and recommendations on a particular company’s stock? 4. What is a dividend? 5. If I hear about an upcoming Initial Public Offering (IPO), how can I buy into it? 6. I always hear about investors shorting a stock. What does that mean? 7. What are the differences between preferred and common stocks? 8. What is a decent return for non-professional investors? 9. Should I invest in a hedge fund? 10. What is an ETF — and should I buy one? |

| Here's How 9 Kingpins Made $2.6 Billion Last Year -- And Got Subsidized By Taxpayers Private-equity kingpins made billions last year subsidized by you, the taxpayer.The nine highest-paid private-equity executives in the U.S. hauled in more than $2.6 billion in 2013, The Wall Street Journal’s Ryan Dezember reported on Tuesday, citing regulatory filings by their firms. That’s not a misprint: Just nine human beings split a $2.6 billion jackpot last year.

Salaries made up only a tiny sliver of this pay, according to the Journal. Most of the income consisted of dividends and profits on investments their firms made. That included hundreds of millions of dollars of what is called “carried interest” — a slice of a firm’s investment returns that is regularly paid to hedge-fund and private-equity managers and taxed at the capital-gains rate of just 15 percent, instead of being taxed like regular income. The Journal did not break down how much money, in total, these men made in carried interest, aside from offering just a couple of examples: Henry Kravis and George Roberts of the firm KKR each made $43.3 million in carried interest, or about a quarter of their total haul. But the overall numbers involved here are huge: Closing the carried-interest loophole could raise $21 billion for the federal government over 10 years, according to one estimate by the tax-reform advocacy group Citizens for Tax Justice. This loophole is one big reason why a tiny sliver of the very wealthy has pulled away from even other members of the 1 percent. President Obama’s proposed federal budget for the fiscal year 2015, unveiled on Tuesday, asks to close this loophole to help pay for a tax break that could lift 13.5 million working people out of poverty. Even some Republicans support the idea, at least partly: House Ways And Means Committee Chairman Dave Camp (R-Mich.), last week proposed closing the carried-interest loophole, sparking apoplexy by the private-equity industry. But, oh well, too bad, working poor people, no tax breaks for you: Obama’s proposal is reportedly a non-starter in Congress, as it has been every other year that Obama has raised it. Why? Because reasons, that’s why! Wealthy fund managers pay an awful lot of money to politicians to encourage them to keep the loophole closed, and nobody wants to stop that gravy train. And these wealthy fund managers get very, very angry about any effort to take away a tiny bit of their billions. Blackstone Group co-founder Stephen Schwarzman — who made $465.4 million in 2013, according to the Journal — declared in 2010 that Obama’s idea of raising taxes on him and his buddies was just “like when Hitler invaded Poland in 1939.” If this is a war, it’s one being waged on the poor. And Schwarzman and his buddies are winning. |

| One-Percent Jokes And Plutocrats In Drag: What I Saw When I Crashed A Wall Street Secret Society By Kevin Roose  Recently, our nation’s financial chieftains have been feeling a little unloved. Venture capitalists are comparing the persecution of the rich to the plight of Jews at Kristallnacht, Wall Street titans are saying that they’re sick of being beaten up, and this week, a billionaire investor, Wilbur Ross, proclaimed that “the 1 percent is being picked on for political reasons.”Ross’s statement seemed particularly odd, because two years ago, I met Ross at an event that might single-handedly explain why the rest of the country still hates financial tycoons – the annual black-tie induction ceremony of a secret Wall Street fraternity called Kappa Beta Phi.Adapted from Kevin Roose’s book Young Money, published today by Grand Central Publishing. “Good evening, Exalted High Council, former Grand Swipes, Grand Swipes-in-waiting, fellow Wall Street Kappas, Kappas from the Spring Street and Montgomery Street chapters, and worthless neophytes!” It was January 2012, and Ross, wearing a tuxedo and purple velvet moccasins embroidered with the fraternity’s Greek letters, was standing at the dais of the St. Regis Hotel ballroom, welcoming a crowd of two hundred wealthy and famous Wall Street figures to the Kappa Beta Phi dinner. Ross, the leader (or “Grand Swipe”) of the fraternity, was preparing to invite 21 new members — “neophytes,” as the group called them — to join its exclusive ranks. Looking up at him from an elegant dinner of rack of lamb and foie gras were many of the most famous investors in the world, including executives from nearly every too-big-to-fail bank, private equity megafirm, and major hedge fund. AIG CEO Bob Benmosche was there, as were Wall Street superlawyer Marty Lipton and Alan “Ace” Greenberg, the former chairman of Bear Stearns. And those were just the returning members. Among the neophytes were hedge fund billionaire and major Obama donor Marc Lasry and Joe Reece, a high-ranking dealmaker at Credit Suisse. [To see the full Kappa Beta Phi member list, click here.] All told, enough wealth and power was concentrated in the St. Regis that night that if you had dropped a bomb on the roof, global finance as we know it might have ceased to exist. During his introductory remarks, Ross spoke for several minutes about the legend of Kappa Beta Phi – how it had been started in 1929 by “four C+ William and Mary students”; how its crest, depicting a “macho right hand in a proper Savile Row suit and a Turnbull and Asser shirtsleeve,” was superior to that of its namesake Phi Beta Kappa (Ross called Phi Beta Kappa’s ruffled-sleeve logo a “tacit confession of homosexuality”); and how the fraternity’s motto, “Dum vivamus edimus et biberimus,” was Latin for “While we live, we eat and drink.” On cue, the financiers shouted out in a thundering bellow: “DUM VIVAMUS EDIMUS ET BIBERIMUS.” The only person not saying the chant along with Ross was me — a journalist who had sneaked into the event, and who was hiding out at a table in the back corner in a rented tuxedo. I’d heard whisperings about the existence of Kappa Beta Phi, whose members included both incredibly successful financiers (New York City’s Mayor Michael Bloomberg, former Goldman Sachs chairman John Whitehead, hedge-fund billionaire Paul Tudor Jones) and incredibly unsuccessful ones (Lehman Brothers CEO Dick Fuld, Bear Stearns CEO Jimmy Cayne, former New Jersey governor and MF Global flameout Jon Corzine). It was a secret fraternity, founded at the beginning of the Great Depression, that functioned as a sort of one-percenter’s Friars Club. Each year, the group’s dinner features comedy skits, musical acts in drag, and off-color jokes, and its group’s privacy mantra is “What happens at the St. Regis stays at the St. Regis.” For eight decades, it worked. No outsider in living memory had witnessed the entire proceedings firsthand. I wanted to break the streak for several reasons. As part of my research for my book, Young Money, I’d been investigating the lives of young Wall Street bankers – the 22-year-olds toiling at the bottom of the financial sector’s food chain. I knew what made those people tick. But in my career as a financial journalist, one question that proved stubbornly elusive was what happened to Wall Streeters as they climbed the ladder to adulthood. Whenever I’d interviewed CEOs and chairmen at big Wall Street firms, they were always too guarded, too on-message and wrapped in media-relations armor to reveal anything interesting about the psychology of the ultra-wealthy. But if I could somehow see these barons in their natural environment, with their defenses down, I might be able to understand the world my young subjects were stepping into. So when I learned when and where Kappa Beta Phi’s annual dinner was being held, I knew I needed to try to go. Getting in was shockingly easy — a brisk walk past the sign-in desk, and I was inside cocktail hour. Immediately, I saw faces I recognized from the papers. I picked up an event program and saw that there were other boldface names on the Kappa Beta Phi membership roll — among them, then-Citigroup CEO Vikram Pandit, BlackRock CEO Larry Fink, Home Depot billionaire Ken Langone, Morgan Stanley bigwig Greg Fleming, and JPMorgan Chase vice chairman Jimmy Lee. Any way you count, this was one of the most powerful groups of business executives in the world. (Since I was a good 20 years younger than any other attendee, I suspect that anyone taking note of my presence assumed I was a waiter.) I hadn’t counted on getting in to the Kappa Beta Phi dinner, and now that I had gotten past security, I wasn’t sure quite what to do. I wanted to avoid rousing suspicion, and I knew that talking to people would get me outed in short order. So I did the next best thing — slouched against a far wall of the room, and pretended to tap out emails on my phone. After cocktail hour, the new inductees – all of whom were required to dress in leotards and gold-sequined skirts, with costume wigs – began their variety-show acts. Among the night’s lowlights: • Paul Queally, a private-equity executive with Welsh, Carson, Anderson, & Stowe, told off-color jokes to Ted Virtue, another private-equity bigwig with MidOcean Partners. The jokes ranged from unfunny and sexist (Q: “What’s the biggest difference between Hillary Clinton and a catfish?” A: “One has whiskers and stinks, and the other is a fish”) to unfunny and homophobic (Q: “What’s the biggest difference between Barney Frank and a Fenway Frank?” A: “Barney Frank comes in different-size buns”). • Bill Mulrow, a top executive at the Blackstone Group (who was later appointed chairman of the New York State Housing Finance Agency), and Emil Henry, a hedge fund manager with Tiger Infrastructure Partners and former assistant secretary of the Treasury, performed a bizarre two-man comedy skit. Mulrow was dressed in raggedy, tie-dye clothes to play the part of a liberal radical, and Henry was playing the part of a wealthy baron. They exchanged lines as if staging a debate between the 99 percent and the 1 percent. (“Bill, look at you! You’re pathetic, you liberal! You need a bath!” Henry shouted. “My God, you callow, insensitive Republican! Don’t you know what we need to do? We need to create jobs,” Mulrow shot back.) • David Moore, Marc Lasry, and Keith Meister — respectively, a holding company CEO, a billionaire hedge-fund manager, and an activist investor — sang a few seconds of a finance-themed parody of “YMCA” before getting the hook. • Warren Stephens, an investment banking CEO, took the stage in a Confederate flag hat and sang a song about the financial crisis, set to the tune of “Dixie.” (“In Wall Street land we’ll take our stand, said Morgan and Goldman. But first we better get some loans, so quick, get to the Fed, man.”) A few more acts followed, during which the veteran Kappas continued to gorge themselves on racks of lamb, throw petits fours at the stage, and laugh uproariously. Michael Novogratz, a former Army helicopter pilot with a shaved head and a stocky build whose firm, Fortress Investment Group, had made him a billionaire, was sitting next to me, drinking liberally and annotating each performance with jokes and insults. “Can you fuckin’ believe Lasry up there?” Novogratz asked me. I nodded. He added, “He just gave me a ride in his jet a month ago.” The neophytes – who had changed from their drag outfits into Mormon missionary costumes — broke into their musical finale: a parody version of “I Believe,” the hit ballad from The Book of Mormon, with customized lyrics like “I believe that God has a plan for all of us. I believe my plan involves a seven-figure bonus.” Amused, I pulled out my phone, and began recording the proceedings on video. Wrong move. “Who the hell are you?” Novogratz demanded. I felt my pulse spike. I was tempted to make a run for it, but – due to the ethics code of the New York Times, my then-employer – I had no choice but to out myself. “I’m a reporter,” I said. Novogratz stood up from the table. “You’re not allowed to be here,” he said. I, too, stood, and tried to excuse myself, but he grabbed my arm and wouldn’t let go. “Give me that or I’ll fucking break it!” Novogratz yelled, grabbing for my phone, which was filled with damning evidence. His eyes were bloodshot, and his neck veins were bulging. The song onstage was now over, and a number of prominent Kappas had rushed over to our table. Before the situation could escalate dangerously, a bond investor and former Grand Swipe named Alexandra Lebenthal stepped in between us. Wilbur Ross quickly followed, and the two of them led me out into the lobby, past a throng of Wall Street tycoons, some of whom seemed to be hyperventilating. Once we made it to the lobby, Ross and Lebenthal reassured me that what I’d just seen wasn’t really a group of wealthy and powerful financiers making homophobic jokes, making light of the financial crisis, and bragging about their business conquests at Main Street’s expense. No, it was just a group of friends who came together to roast each other in a benign and self-deprecating manner. Nothing to see here. But the extent of their worry wasn’t made clear until Ross offered himself up as a source for future stories in exchange for my cooperation. “I’ll pick up the phone anytime, get you any help you need,” he said. “Yeah, the people in this group could be very helpful,” Lebenthal chimed in. “If you could just keep their privacy in mind.” I wasn’t going to be bribed off my story, but I understood their panic. Here, after all, was a group that included many of the executives whose firms had collectively wrecked the global economy in 2008 and 2009. And they were laughing off the entire disaster in private, as if it were a long-forgotten lark. (Or worse, sing about it — one of the last skits of the night was a self-congratulatory parody of ABBA’s “Dancing Queen,” called “Bailout King.”) These were activities that amounted to a gigantic middle finger to Main Street and that, if made public, could end careers and damage very public reputations. After several more minutes spent trying to do damage control, Ross and Lebenthal escorted me out of the St. Regis. As I walked through the streets of midtown in my ill-fitting tuxedo, I thought about the implications of what I’d just seen. The first and most obvious conclusion was that the upper ranks of finance are composed of people who have completely divorced themselves from reality. No self-aware and socially conscious Wall Street executive would have agreed to be part of a group whose tacit mission is to make light of the financial sector’s foibles. Not when those foibles had resulted in real harm to millions of people in the form of foreclosures, wrecked 401(k)s, and a devastating unemployment crisis. The second thing I realized was that Kappa Beta Phi was, in large part, a fear-based organization. Here were executives who had strong ideas about politics, society, and the work of their colleagues, but who would never have the courage to voice those opinions in a public setting. Their cowardice had reduced them to sniping at their perceived enemies in the form of satirical songs and sketches, among only those people who had been handpicked to share their view of the world. And the idea of a reporter making those views public had caused them to throw a mass temper tantrum. The last thought I had, and the saddest, was that many of these self-righteous Kappa Beta Phi members had surely been first-year bankers once. And in the 20, 30, or 40 years since, something fundamental about them had changed. Their pursuit of money and power had removed them from the larger world to the sad extent that, now, in the primes of their careers, the only people with whom they could be truly themselves were a handful of other prominent financiers. Perhaps, I realized, this social isolation is why despite extraordinary evidence to the contrary, one-percenters like Ross keep saying how badly persecuted they are. When you’re a member of the fraternity of money, it can be hard to see past the foie gras to the real world. Revealed: The Full Membership List of Wall Street’s Secret Society |

| Income Inequality: A Problem No One Wants To Fix Not only do the 30 richest Americans own as much wealth (about $792 billion) as 157 million people, our middle class is further from the top than in all other developed countries.  Inequality is a cancer on society, here in the U.S. and across the globe. It keeps growing. But humanity seems helpless against it, as if it’s an alien force that no one understands, even as the life is being gradually drained from its victims.The recent Oxfam report on global wealth inequality reveals some of the ugly extremes that have divided our world. It also directs our attention to the Global Wealth Report compiled by Credit Suisse, and the companion Databook, which offer a shocking testament to the severity of U.S. and global inequality. 1. The 30 Richest Americans Own as much as Half of the U.S. Population In the U.S., the richest 30 individuals own about $792 billion, while the bottom half of Americans own 1.1 percent of our country’s wealth, also about $792 billion. That’s 30 people owning as much as 157,000,000 people. This information is derived from the Global Wealth Databook and the Forbes 400 List. More details are provided at Us Against Greed. 2. The Bottom Half of America Owns a Smaller Percentage of National Wealth than Almost All Other Countries and Continents It goes beyond the poorest half. The upper-middle class of America (roughly $50,000 to $200,000 in wealth) own a smaller percentage of wealth than the corresponding upper-middle classes of China and India. Of course, America’s lower and middle classes have more money in absolute terms than corresponding classes in China and India. But that leads to the next topic. 3. Less Mobility: North America’s Bottom Half Has Less Chance to MOVE UP than Any Other Region of the World The results of a Credit Suisse wealth mobility simulation are given in the Global Wealth Databook: “North America is…less mobile than other regions, especially over longer time horizons. Europe is next in line, followed by the middle group of Asia-Pacific, Latin America and Africa. The most mobile regions are China and India.” 4. America’s MIDDLE CLASS is Further from the Top than in All Other Developed Countries For the world as a whole, the median is only 8 percent of the mean, reflecting the fact that half the world’s adults average less than $500 in wealth. The Greatest Shock: How Little is Needed to Restore Some Sanity The stock market grew by $4.7 trillion in 2013. A wealth tax of just a one-tenth of 1 percent (one dollar out of every thousand) would have provided the $4 billion needed to shelter every homeless American for 365 days. But we have no wealth tax. And the wealth just keeps growing for the wealthiest Americans. |

| Inequality and the Nature of Capital: A Reminder to Economists Complaints about inequality have taken the West by storm, and that accounts for the success of the book “Capital in the Twenty-First Century” by economist Thomas Piketty. Inequality is not a new topic for developing nations, notes author Chandran Nair.“Piketty, like every other economist, seeks to explain the world with reference to economic capital alone while ignoring the mother of all capitals — natural capital,” Nair writes. “Our economic model not only allows for but thrives on what is essentially a collective free ride on the back of natural capital.”

Natural capital, including freshwater, clean air and rich soil, is underpriced and subject to massive overconsumption. Focus on economic inequality without proper management of natural capital will result in ongoing disasters including climate change. While Piketty recommends a global wealth tax, Nair suggests taxing access to natural resources. Nair concludes that addressing inequality in developing countries is the defining challenge of the 21st century. – YaleGlobal HONG KONG — Despite the recent economic crises that hit so suddenly and surprised experts, economists still hold sway with the media, policymakers and business leaders. Thomas Piketty’s book, “Capital in the Twenty-First Century,” has made waves not just in the rarified world of economics but as a bestseller amongst the general public. His argument is that the “normal” state of capitalism is one where the rate of return on capital exceeds economic growth, therefore allowing high rates of inequality to persist over the long-run. Just about every self-respecting intellectual in the western world has felt the need to respond, and opinions have divided fairly predictably along ideological lines. Piketty hit the headlines a second time after various experts called into question the accuracy of his underlying data. The analysis focuses on whether Piketty is right or wrong. Few have asked the more important question of whether he simply missed the point. For something named “Capital in the Twenty-First Century,” the book is rooted in the very 20th-century notion that what happens in the West exclusively shapes the world and its future. It goes without saying that much of the book’s success is because inequality is the intellectual flavor of the month in the West. Considering the shock and fervor of these discussions, one could almost be forgiven for assuming inequality is a phenomenon only recently discovered. Perhaps that’s the case for many in the West. But for the rest of the world, much of which has experienced the truly heinous inequalities associated with the colonialism that so enriched the West, the discussion is old hat. Many countries are only recently recovering from the effects of plundering, destruction of social and cultural institutions, and resource extraction. Ironically, the realm of finance now labels these nations as “emerging markets.” And yet Piketty’s analysis is framed exclusively by western historical experience and thus unfortunately ignores the context in which western wealth creation occurred, despite the fact that many seek to perpetuate and emulate it today. For this reason, one suspects that if someone were to ask Narendra Modi if he agrees with Piketty’s analysis, India’s new prime minister would likely say it is irrelevant to him and to India. For that matter so would Xi Jinping, China’s president, and Joko Widodo, the front-runner as president of Indonesia — and there you have the leaders of almost 3 billion people. Piketty, like every other economist, seeks to explain the world with reference to economic capital alone while ignoring the mother of all capitals — natural capital. This is a rejection of the scientific evidence on the state of the world. In a world subject to the laws of nature, the hierarchy of capitals is as follows: First is natural capital, which is the stock of natural assets including water, air, flora and fauna, geology, soil, and more. Natural capital provides the stock of ecosystem services, on which human life depends and which is the basis for all production. Then, there is human capital, concerning the welfare of human beings and our wellness, health, ideas, motivation and creativity — all of which are vital to productive work. Third, there is social capital, which is less about one’s standing amongst peers and more about the institutions that allow people to realize their potential including education, law and order, health care and the various family, community and religious organizations. Only after all of this do we come to economic capital, the least important of the four. It is far easier to live without your stock options than it is without your water supply, health, or law and order. In fact, economic capital has no intrinsic value, but is important only as a means of trading or owning the other types of capital. A world where cash, bonds, stock and other financial instruments were all that existed would be a world where the sum total of wealth was zero. This is why the true problem with the current model of capitalism is not that some people have too much economic capital and others too few, but that our economic model not only allows for but thrives on what is essentially a collective free ride on the back of natural capital. Addressing inequality in developing countries, not the West, while at the same time sustainably managing natural capital, will therefore be the defining challenge of the 21st century. That the billions in India and China live in crowded poverty compared to the prosperous West is something their governments must act on. What is often ignored is the most acute form of inequality around: that which exists between those at the bottom of the economic ladder and those not on the ladder at all — that is, the hundreds of millions around the world who lack access to even the most basic resources like housing, secure and safe food, clean water and basic sanitation. Because these people are not even part of the economic system — they are, quite literally, disenfranchised — their complaints are not heard on Facebook or Twitter. Helping them is not a matter of increasing economic capital but rather protecting and equitably distributing natural capital. By underpricing natural capital and externalizing the costs of problems such as soil degradation and carbon emissions, as well as keeping some of our most valuable resources such as clean air and water free in the name of economic growth, governments promote massive consumption in the short term. But in the long run, the inevitable outcome is a depletion of the planet’s resources, making sustaining ourselves increasingly difficult and creating social unrest as billions of people are denied access to the basic resources that are everybody’s right. To give just one example, Burma is now one of the world’s hottest markets. It also has one of the worst rates of deforestation in the world, losing 20 percent of its forest cover between 1990 and 2010. Those who actually live there, however, have little say in the fate of the ecosystem services such as forests they depend on, which are under threat in the name of attracting foreign investment and generating economic capital. So long as policymakers continue to see the world through the lens of economic capital alone and focus only on technical indicators like the Gini coefficient, the damage done to human, social and natural capital will go unnoticed. This makes moving in the right direction impossible. The truth is that even a far more equitable form of capitalism that promotes consumption and short-term growth over proper management of natural capital will result in disaster. Ever rising carbon emissions and the associated effects climate change are proof of this. Piketty’s key recommendation is a global wealth tax which would take from the rich and provide for the poor. By now it should be clear that the redistribution of economic capital alone would be akin to more equitably distributing the silverware at a dinner table without any food. A more farsighted solution would be a hefty tax by the state on access to natural resources so that economic growth is no longer based on polluting water supplies, degrading arable land or producing cheap and unhealthy food — all with literally no financial consequence. To have a fighting chance at addressing the root cause of global inequalities, the first step is to stop looking in the wrong place. Chandran Nair is the founder and CEO of the Global Institute For Tomorrow (GIFT). He is the author of Consumptionomics: Asia’s Role in Reshaping Capitalism and Saving the Planet and the creator of The Other Hundred. |

| Reinhart And Rogoff's Pro-Austerity Research Now Even More Thoroughly Debunked By Studies The debunking of Carmen Reinhart and Kenneth Rogoff continues.

The Harvard economists have argued that mistakes and omissions in their influential research on debt and economic growth don’t change their ultimate austerity-justifying conclusion: That too much debt hurts growth. But even this claim has now been disproved by two new studies, which suggest the opposite might in fact be true: Slow growth leads to higher debt, not the other way around. In a post at Quartz, University of Michigan economics professor Miles Kimball and University of Michigan undergraduate student Yichuan Wang write that they have crunched Reinhart and Rogoff’s data and found “not even a shred of evidence” that high debt levels lead to slower economic growth. And a new paper by University of Massachusetts professor Arindrajit Dube finds evidence that Reinhart and Rogoff had the relationship between growth and debt backwards: Slow growth appears to cause higher debt, if anything. As you can see from the chart from Dube’s paper below, growth tends to be slower in the five years before countries have high debt levels. In the five years after they have high debt levels, there is no noticeable difference in growth at all, certainly not at the 90 percent debt-to-GDP level that Reinhart and Rogoff’s 2010 paper made infamous. Kimball and Wang present similar findings in their Quartz piece. This contradicts the conclusion of Reinhart and Rogoff’s 2010 paper, “Growth in a Time of Debt,” which has been used to justify austerity programs around the world. In that paper, and in many other papers, op-ed pieces and congressional testimony over the years, Reinhart And Rogoff have warned that high debt slows down growth, making it a huge problem to be dealt with immediately. The human costs of this error have been enormous. Even after University of Massachusetts graduate student Thomas Herndon found Reinhart and Rogoff’s work included errors and that their 2010 paper was missing important data, the researchers stood by their ultimate conclusion: that growth dropped off significantly after debt hit 90 percent of GDP. They claimed that austerity opponents like Paul Krugman have been so so rude to them for no good reason. At the same time, they have tried to distance themselves a bit from the chicken-and-egg problem of whether debt causes slow growth, or vice-versa. “The frontier question for research is the issue of causality,” they said in their lengthy New York Times piece responding to Herndon. It looks like they should have thought a little harder about that frontier question three years ago. |

| The Short Guide To Capital In The 21st Century Thomas Piketty’s Capital in the 21st Century is the most important economics book of the year, if not the decade. It’s also 696 pages long, translated from French, filled with methodological asides and in-depth looks at unique data, packed with allusions to 19th century novels, and generally a bit of a slog.The good news is that there’s no advanced math, and anyone who puts in the time can read the book. But if you just want the bottom line, we have you covered.

Can you give me Piketty’s argument in four bullet points?

Who is Thomas Piketty? What does Capital in the 21st Century argue? What is capital? Does this have anything to do with Karl Marx’s Das Kapital? vision of a class-ridden, neo-Victorian society dominated by the unearned wealth of a hereditary elite. During the Cold War years it appeared that Marx was simply wrong to assert that market societies would be dominated by owners of capital. Wages for ordinary workers were high and rising. Economic elites were largely business executives or skilled tradespeople (lawyers and surgeons, say) rather than owners of enterprises. And iconic “capitalist” figures were entrepreneurs who built businesses rather than heirs to old fortunes. Political debate focused largely on the question of a welfare state or social safety net for the poor, not the fundamental architecture of capitalism. Piketty says that this was essentially a happy coincidence reflecting the unique circumstances of the post-war era. The fortunes of the wealthy were destroyed by two world wars, the Great Depression, and extreme wartime finance measures. Then a few decades of rapid economic growth created a situation in which newly earned income was a much bigger deal than old wealth. In the contemporary environment of slow economic growth, Piketty says this process is over. Unless drastic measures are taken, the future belongs to people who simply own stuff they inherited from their parents. What are Piketty’s key concepts? The rate of return on capital, r, is a more abstract idea. If you invest $100 in some enterprise and it returns you $7 a year in income then your rate of return is 7%. Piketty’s r is the rate of return on all outstanding investments. A key contention of the book is that r is about 5 percent on average at all times. The growth rate (g) that matters is the overall rate of economic growth. That means that if g is less than 5 percent, the wealth of the already-wealthy will grow faster than the economy as a whole. In practice, g has been below 5 percent in recent decades and Piketty expects that trend to continue. Because r > g, the rich will get richer What is Piketty’s main finding? But Piketty also finds that the increase in wealth:income ratio is not unique to the inequality-friendly Anglo-Saxon economies of the United States and Canada. In fact, the accumulation of wealth is most clearly seen in places like France and especially Italy where economic growth has been very slow. Piketty also finds that the rate of return on capital is about 5 percent on average across different countries. That’s part of why he argues that the dynamic towards wealth inequality is built into capitalism rather than any one country’s economic policies. How does Piketty explain this? Since r is usually larger than g, the wealthy get wealthier. The poor don’t necessarily get poorer, but the gap between the earnings power of people who own lots of buildings and shares and the earnings power of people working for a living will grow and grow. If it’s that simple, how come nobody noticed before? His second point is is to concede that the life experience of the non-Millenials alive today contradicted this narrative. World War I directly destroyed some wealth, and also led to very high levels of taxation and inflation as wartime finance measures. Then came the Great Depression in which many fortunes were wiped out. Then came World War II which directly destroyed even more wealth (as in cities were literally burned to the ground) and was associated with even more extreme wartime finance measures. Then came a fast period of postwar growth associated with European reconstruction and the unleashing of long-suppressed consumption impulses. It’s only over the past 20 or 30 years that the underlying dynamic has reasserted itself. Why does this matter? Piketty’s vision of a class-ridden, neo-Victorian society dominated by the unearned wealth of a hereditary elite cuts sharply against both liberal notions of a just society andconservative ideas about what a dynamic market economy is supposed to look like. Market-oriented thinkers valorize the idea of entrepreneurial capitalism, but Piketty says we are headed for a world of patrimonial capitalism where the Forbes 400 list will be dominated not by the founders of new companies but by the grandchildren of today’s super-elite. What is to be done? Boosting economic growth is something politicians are always promising to do. The kind of international cooperation Piketty calls for is difficult to imagine happening in practice. And his enthusiasm for wealth taxes runs against decades of conventional wisdom in the economics profession holding that people should be encouraged to save and invest. Many people who find Piketty’s positive analysis to be important and at least partially persuasive are going to disagree with his prescription here. What are the main weaknesses of Piketty’s book? Piketty says that r = 5 percent regardless of the rate of growth and provides fairly convincing empirical evidence that this has been the case in the past. But the theoretical basis for this pattern is unclear so it might not hold up. In principle, a permanent slowdown in growth could lead to a concurrent slowdown in the rate of return on capital leading to a stabilization in the wealth-income ratio. In that case, either everything would be fine or else if things weren’t fine it would be because the growth rate is too low not because the wealth-income ratio is rising. A related issue is Piketty’s treatment of the growth rate. Boosting economic growth is something politicians are always promising to do. And according to Piketty, growth-boosting policies would forestall the growth of patrimonial capitalism. Piketty believes that economic growth is driven by deep structural factors related to demographics and technology rather than policy changes. This isn’t a unique view of his by any means (Northwestern University Professor Robert Gordon has been arguing something quite similar recently in a different context) but it manages to be central to the book’s conclusion without being extensively defended in the text. What are some other possible solutions to the problem Piketty diagnoses? We also might consider wealth-destruction methods that are a little more narrowly tailored than a broad wealth tax (or a world war). For example, much of modern-day wealth appears to take the form of urban land (Silicon Valley houses are much more expensive than houses in the Houston suburbs, not because the houses are bigger but because the land is more expensive), control over oil and other fossil fuel resources, and the value associated with various patents, copyrights, trademarks, and other forms of intellectual property. Land and resources differ from traditional capital in that even a very high rate of taxation on them won’t cause the land to go away or the oil to vanish. Intellectual property is deliberately created by the government. Stiff land taxes, and major intellectual property reform could achieve many of Piketty’s goals without disincentivizing saving and wealth creation. What else should I read about this? From the right, Ryan Decker argues that Piketty’s work is more about accounting than economics and James Pethokoukis argues that his assumptions about the future are unfounded. |

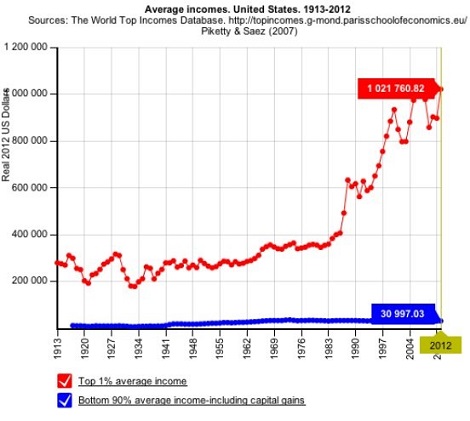

Any Hope Of American Equality Died In The 1980s (And Here's Proof) That growing divide between the rich and you? It’s not just in your mind, and it’s certainly not just a couple years in the making. That growing divide between the rich and you? It’s not just in your mind, and it’s certainly not just a couple years in the making.

Actually, the average incomes of the top 1 percent of Americans have grown steadily over the last century or so, especially when compared to the flat-lining incomes for the bottom 90 percent of Americans. But as you can see in the above chart, it wasn’t until the 1980s that the rich really started to pull away from the normals. We created the chart using the World Income Database, a collection of data compiled by a group of economists who focus on the incomes of the rich, poor and middle-class. The chart plots the average income of the top 1 percent of American earners against the average income for the bottom 90 percent of Americans between 1913 and 2012, using real 2012 dollars. In 2012, the top 1 percent took home more than $1 million on average, while the average income of the bottom 90 percent of Americans was $30,438. Compare that to 1917, when the top 1 percent’s average income was just under $300,000 and the bottom 90 percent took home slightly more than $11,000 on average. So how is it that the U.S. income gap has grown large enough for us to claim the title of worst inequality in the developed world? There are a variety of explanations: 1. Tax Cuts For The Rich: Many of the spikes in the chart correspond with periods when the government slashed taxes on the rich. As the Center for American Progress notes, Ronald Reagan’s early 1980s tax reforms helped to increase income inequality. The same thing happened in the late 1990s when Bill Clinton passed a tax cut on capital gains, or investment income, which rich people are more likely to have than ordinary Americans. And then it happened again when George W. Bush cut the top marginal tax rates in 2001 and 2003. Altogether, about 30 percent of the expansion of the after-tax income gap between 1979 and 2007 was due to tax and budget policies becoming less progressive, according to a June analysis from the Economic Policy Institute. 2. Corporate Profits And Executive Pay Are Soaring: Over the past several years corporate profits — which go in large part to rich investors — have soared to the point where they now make up the highest share of the economy on record. And over the last several decades, CEO pay also skyrocketed. The result: The ratio between CEO and average worker pay ballooned by roughly 1,000 percent since 1950. 3. The Wages Of Regular Workers Haven’t Kept Up With Productivity: In the 1960s workers and their families used to be able to live above the poverty line on a minimum wage income. But now, that’s no longer the case, according to EPI. In fact, if the minimum wage had kept up with boosts in worker productivity over the past several decades it would be $18.30, according to EPI. That’s more than double the current minimum wage of $7.25. Part of the reason workers have had a tougher time securing higher wages in recent years is because of a marked decline in unionization. Drops in union membership typically correspond with growth in income inequality, research finds. |

|

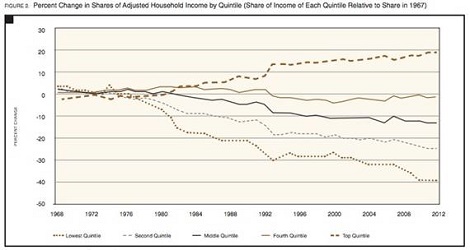

Next Time Someone Argues For 'Trickle-Down' Economics, Show Them This Conservatives like to say that “a rising tide lifts all boats.” In other words, if an executive makes $20 million a year, his income will eventually trickle down into the rest of the economy and ultimately benefit poor people.

But that theory hasn’t exactly proven true. The highest-earning 20 percent of Americans have been making more and more over the past 40 years. Yet no other boats have risen; in fact, they’re sinking. Over the same 40 years, the lowest-earning 60 percent of Americans have been making less and less. Imagine the lines below as tides. As you can see, one is rising, while the others are falling (and one is stagnant): Other studies have shown a correlation between bigger tax cuts for the 1 percent and income inequality. In the U.S., the top earners have made more money in the last 60 years as the top marginal tax rate has been slashed and the rising dominance of Wall Street allowed a few to make enormous profits. An OECD study in 2013 found that the U.S. had the highest income inequality in the developed world. Out of all nations, only Chile, Mexico and Turkey had higher levels of income inequality, according to the study. So what does this all mean in actual dollars? It means that more than half of U.S. wage earners made less than $30,000 in 2012, which is not far above the $27,010 federal poverty line for a family of five. Meanwhile, the top 10 percent of earners took more than half of the country’s total income in 2012. In other words, a rising tide has lifted a few big boats and washed the rest aside. |